The double whammy of economic disruptions from the COVID-19 pandemic and subsequent record inflation have Americans going without food at rates not seen since the last American financial crisis.

As costs have risen at grocery stores and restaurants, Link2Feed analyzed data from the Department of Agriculture on food insecurity rates across different demographics to illustrate which Americans are more likely to go without food. A household is considered food insecure when there is sometimes or often not enough food to eat in a given week.

In the typical American metro area, roughly 1 in 10 households report that they didn't have enough food to eat in their house, according to Census survey data from early March this year.

A lack of access to adequate food is often a result of living in food deserts, either because the house doesn't have transportation or there are no shops nearby. However, since food prices have been rising faster in the last few years than in any other decade in modern history, it can simply be the result of unaffordability. In just four years, the USDA has tracked a 25% increase in the cost of foods at grocery retailers and restaurants.

Residents in Miami, Chicago, Philadelphia, Phoenix, Atlanta, Los Angeles, Detroit, and New York all reported above-average food scarcity levels this spring. In Houston, that figure is 15.7%, higher than any other metro area.

Prolonged food insecurity can result in anxiety, unhealthy food choices, fewer meals, and weight loss, according to the USDA. In some areas, food insecurity has remained stubbornly high since pandemic disruptions started in 2020. The Washington D.C. region for instance—among the most expensive places to live in the country—saw food insecurity levels drop for five years prior to 2020. However, it's remained elevated since then, with around 1 in 3 residents struggling to keep food on hand.

This trend tracks with the rest of the nation, on average, which saw food insecurity rates drop as the economy recovered from the Great Recession in the latter half of the 2010s. Now, as economic instability rears its head once again, food insecurity is affecting some Americans more than others.

Foothold Technology

The disparate impact of rising prices

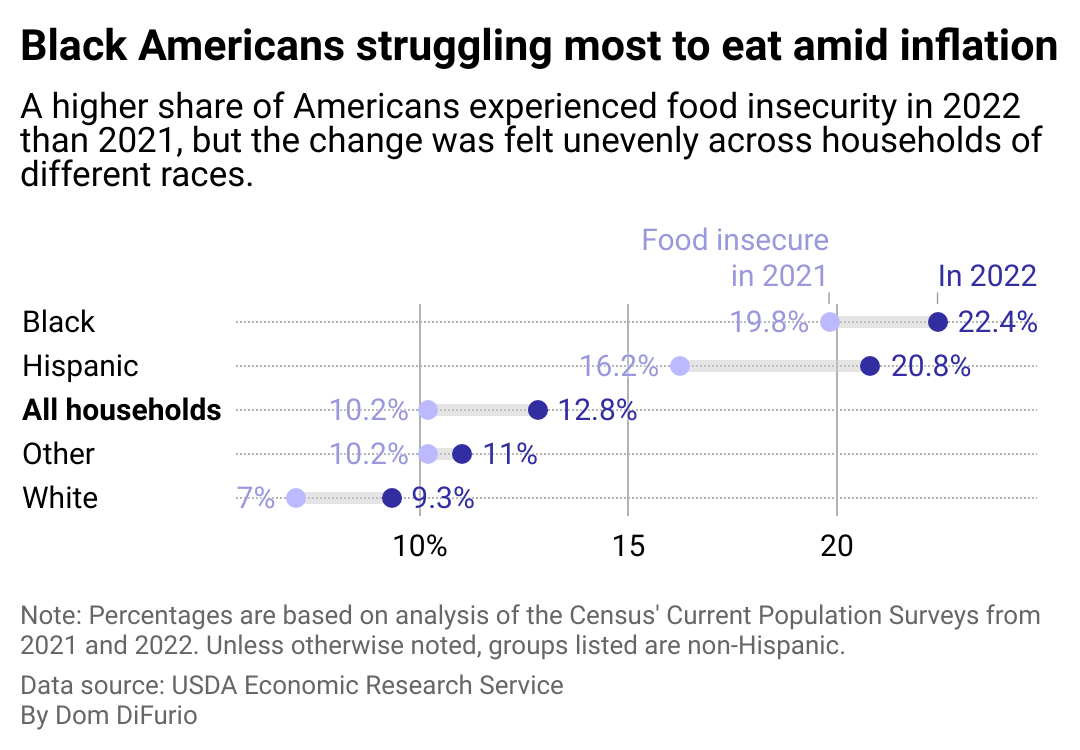

Nearly 1 in 5 households with Black heads of household struggled to keep food on the table in 2021, a figure that only grew in 2022 as inflation reached its peak. Black families are nearly twice as likely to experience food insecurity when compared to all households, according to the USDA's analysis of Census data.

Households headed by a Hispanic-identifying family member saw the largest increase in food insecurity amid peak inflation. Other households, which make up those who may identify as mixed race or another unlisted category, experienced below-average food insecurity, while white households saw the lowest rates.

Federal data on Native American and Alaska Native populations is limited. However, a report released by the USDA's Economic Research Service in April 2024 found that Native American and Alaska Native households were more likely than households headed by people of other races to feel food insecure, at 23% of households. In Utah, new food pantries are being opened to serve Native American residents of the Navajo Nation to accommodate the growing need.

Because food availability is strongly linked to economic outcomes, it also has an outsized impact across different family structures.

Foothold Technology

Food insecurity affects more than just those in poverty

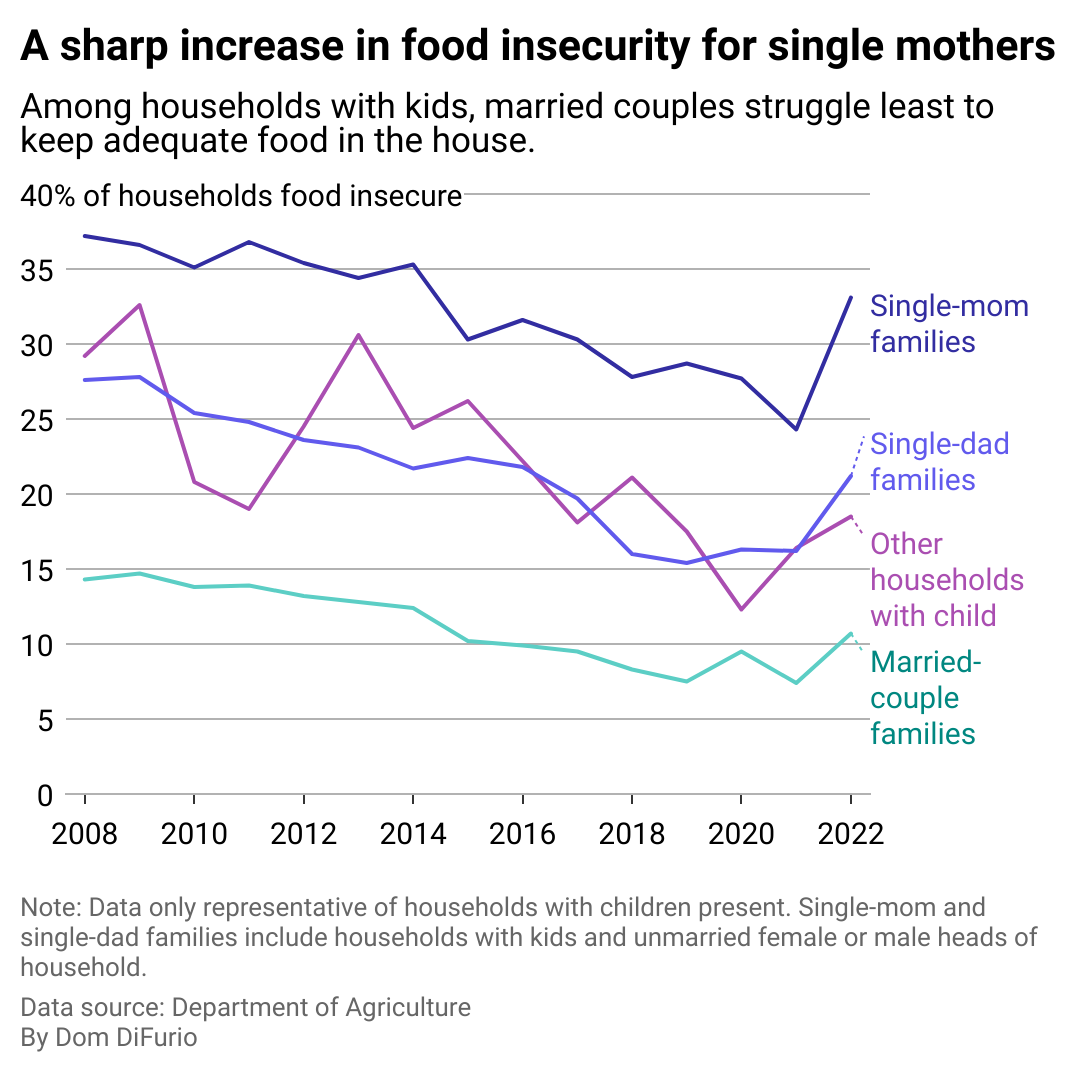

In families where there is only one provider, whether the mother or father, households tend to experience more food insecurity than all others; single-mother-led families rose the most. Married couples experienced the lowest relative rates, although they, too, have experienced increasing unavailability of food around the home as inflation peaked in 2022.

The most economically marginalized Americans may continue struggling to fill their own (and their children's) stomachs, as inflation is proving difficult to stop. In an effort to slow down the rate of price increases on food and more, the Federal Reserve raised interest rates. While that lowered the speed at which prices increased for much of 2023, in recent months, the decline in the inflation rate has stalled at around twice the pre-pandemic norm. About 1 in 3 Americans say they're struggling to afford their usual expenses, and 79% of Americans are worried about what future price increases will mean for their budgets.

Story editing by Elsie Drexler. Copy editing by Tim Bruns.

This story originally appeared on Link2Feed and was produced and distributed in partnership with Stacker Studio.

Embedded JavaScript